1.1 Introduction

In this essay, I will discuss, contrast and compare the three fundamentally different paradigm shifts/schools of economics up against each other with emphasis on one major event of the 20th century. Namely the stagflation. I shall discuss the economics and political events of 1970s and the rise of neoliberal economics with economists such as Milton Friedman. The three schools of economic thought that this paper will use to explain this event are; the Chicago School of Economics, John Maynard Keynes and neo-Marxism.

2.1 The Rise of Neoliberalism: The Context

Firstly, what is neoliberalism? Neoliberalism is what dominated and continues to dominate mainstream economics, it is often referred to as supply side economics or trickledown economics. Neoliberalism is a revival of classical economics in the modern context. However, in some respects it is far more radical than classical economics. Milton Friedman is credited for giving rise of neoliberal economics and their goal was to destroy Keynes and Keynesian economics (Cassidy 2009). It came to prominence in the western world with the rise of Ronald Raegan and Margaret Thatcher (Glyn 2006). Neoliberalism is fundamentally anti-state and quite fervently so. Intervention in the economy by the government and by state is unjust, because firstly, their idea is that the “plutocrats” deserve the capital they have accumulated (Skidelsky 2009). Why? The free market does not discriminate, it is free game that anyone can play and succeed in. All market results according to the neoliberalism are fundamentally just, fair and adheres to their inner sense of social and economic justice (Skidelsky 2009, Cassidy 2009; Keech 2013). What became to dominate the world of economics was the Chicago School of Economics, neoliberalism, neoclassical economics and monetarism (Glyn 2006). The government and the state will then do redistribution of wealth, if intervention, to the workers and to people who have it less well off, because the government is prone to rent-seeking and public choice theory according to the Classicals and Neo-Marxists (Foster and McCheesny 2012, Keech 2013). Rent-seeking as term can be defined as simply as individuals trying to get goods and benefits without giving anything to achieve the former things. Rent-seeking here become the workers trying to use the political power of democracy to redistribute the wealth downwards, and that is fundamentally unjust, because the people on the bottom didn’t earn their wealth. It should be up to capital to decide how the organize and distribute their own means of production and private property as they wish (Sherman and Meeropol 2015). The role of government is minimal in the classical view, it is sort of like a game of American football, as in the government should set the bare minimum rules of the game and then let the athletes compete against each other. More precisely, it is about the government guaranteeing property rights (Sherman and Meeropol 2015; Cassidy 2009; Glyn 2006). That was a bit of contextualization, in this paper, the Chicago School of Economics, and neoclassical economy will be used interchangeably. Classical economics will not be used, because we’re dealing with the larger macroeconomy, while Classical economy was on the microlevel. The application of Classical economics on the macroeconomy will be called neoclassial (Cassidy 2009). However, when people talk about the rise of neoliberalism in the 1970s, they are specifically aiming at the stagflation of the 70s. Why did the stagflation happen and why did it cause the rise of neoliberalism?

3.1 The Rise of Neoliberalism: Why did it happen? The Stagflation of 1970s and how do one explain it?

Firstly, when I refer to Keynes and Keynesianism some people might think I am referring to the earlier paradigm of 1945 until 1970, that is not case. I am more referring to post-Keynesianism, the ideas of Keynes and the post-Keynesians such as Robert Skidelsky. Secondly, when I am referring to neo-Marxism, it is about carrying on the legacy of Marx to some extent, but also the newer ideas that was developed by people such Foster, McCheesny and others in the journal “The Monthly Review”.

Thirdly, what is stagflation. Stagflation is when the economy is experiencing low growth, high unemployment, but high inflation! How do different schools of economic thought explain this phenomenon?

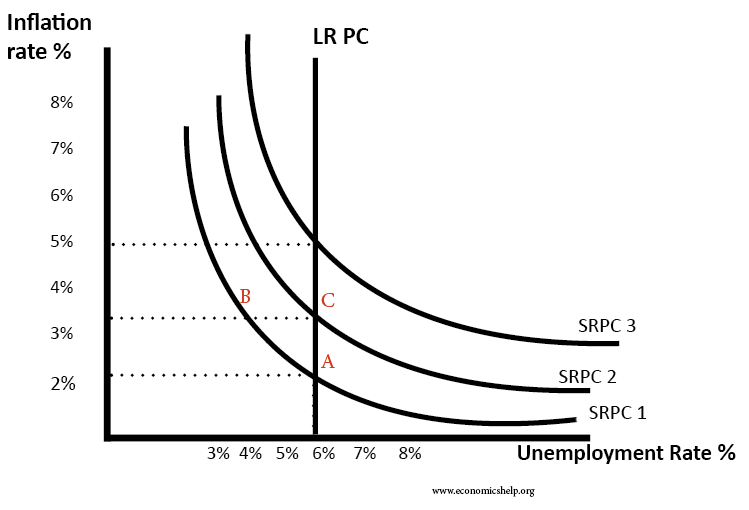

How do the neoclassicals explain the stagflation? One of the narratives is the Philips Curve. Why the Philips Curve? The Philips Curve shows that there is a negative relationship between the rate of unemployment and the rate of inflation. More precisely, the Philips Curves of Milton Friedman. There is some variable at play here, firstly, the natural rate of unemployment, which is determined by the institutions of a country (Glyn 2006). One of the narratives is push cost inflation, which is when unemployment falls below the NAIRU, inflation will pick up rapidly. The institutions of a country have pushed the NAIRU equilibrium higher, thus causing inflation, then this was tried to be corrected with state intervention, which made the situation worse. Then there was a lot of push cost inflation by organized labor, because of money illusion. One of the reasons for push cost inflation is that the prices of keeping up labor, the same output and production becomes a lot more expensive especially when it must keep up with wage growth. Inflation eating into the wages of labor, then organized labor ask for higher rates of wage growth. Say inflation was 3 percent in 2014, then labor is going to try ask for the equivalent or more to keep up with prices. Money illusion is when labor think they had a good wage growth in 2014, because they got a 2 percent wage increase, but that makes their real wage minus 1 percent (Keech 2013; Skidelsky 2009; Sherman and Meeropol 2015)!

In 1970s stagflation, one had years where the inflation was at 12 percent. Imagine yourself as a worker, and after a year suddenly having 12 percent less purchasing power, because inflation gobbles into your wages (Glyn 2006). Friedman and neoclassicals thus argued that Philips curves were happening, because 1) artificially low unemployment below the NAIRU (non-accelerating inflation rate of Unemployment), government intervention on multiple occasions to try to keep people in work when producers fired labor due to increased cost of production 3) inflation didn’t adjust it stayed the same. Thus, high unemployment in the end, low growth due to production becoming stagnant due to variables discussed and inflation continuously staying high (Keech 2013; Glyn 2006; Sherman and Meeropol 2015). What is the remedy to this? The remedy in the classical view is to what Milton Friedman did in Chile, essentially, one has strip down the power of organized labor, limit the welfare state and cut back on institutions that hamper with the beauty, elegance and the sophistication of the free market. Essentially, liberalize and cut back on social democracy, cut taxes for the rich to investment, because saving=investment – inflation in the neoclassical view (Sherman and Meeropol). Profits also is a good indicator of investment (Sherman). If one does this the result is that inflation will start to adjust, Say’s Law (supply creates its own demand), wages will flexible again and the market will return to a full-employment equilibrium with low inflation and growth will pick back up again (Sherman and Meeropol 2015, Cassidy 2009; Keech 2013).

3.2 The Keynesian Counternarrative

The Keynesian counternarrative has to do with the collapse of commodity prices. Firstly, the oil crisis in the 1970s, which caused the prices for energy to become artificially high meaning that consumers had some options. 1) They could keep the same consumption up, but at the cost of their savings 2) they could cut back on non-energy consumption. These two happened but that started pricking the commodity bubble. Capital saw that their profit expectations fall through the floor, liquidity preference kicked in and capital wanted to safeguard their cash. This caused a massive off-loading in the commodity sector and the rational herd kick in as well, in that, when people leave the market in droves that collapsed the sector. This caused the commodity stock market to crash as well, because the stock prices fell off a cliff. Capital then sought refuge for their liquidity in financial instruments such as bonds and obligations became popular and foreign currency investment as well. Some bought a lot of Japanese currency (yen) to keep their cash safe, because buying a bond with a negative interest rates might be better than keeping it in stock and losing 12 percent of it, because those markets carry more risk and are lot more volatile and investors had no appetite for risk and wanted the safe options with low risk and low return, if even any. This saw inflation rapidly increasing, because consumption did not stop it remained relatively the same, but on different products mainly energy. Growth remained low, stagnated, because Americans bought mainly imports of energy from the middle east as in oil. This caused the high inflation, low growth and high unemployment, however, there is no doubt that or organized labor played a role, but the underlying reason of Keynes of what caused it to begin with is different (Skidelsky 2009; Keech 2013; Sherman and Meeropol 2015; Cassidy 2009).

3.3 The Neo-Marxist narrative

The Neo-Marxist narrative mixes both Keynes and the neoclassical view. Firstly, neoclassicals largely agree to the descriptions of capitalism that the neoclassicals use. The neo-Marxists would say that the fundamental conclusion of Friedman et al is what is wrong with capitalism, because of how it favors capital over labor, they would call this social domination. They would argue that the Keynesian argument is more correct, but that fundamentally, when it happened, capitalism was always going to favor capital and continue the social domination of labor by capital (Foster and McCheesny 2012). What could a potential solution be for the neo-Marxists and the Keynesians. One of them could be the subsidization of energy commodities as in trying to keep the artificially high energy prices from rising even more. In one year of the oil crisis, the price of energy commodities had doubled. Meaning that most people would have to spend double of what they usually did on energy, because most people would prioritize having gas in the tank of their car, keeping the heat and the lights on in their house rather than buying other commodities (Skidelsky 2009). The savings people had would be drained, the would have to change the distribution of what they buy, and some would have taken on extra loans to make ends meet. This is fundamentally what is wrong with capitalism to the neo-Marxists and the Keynesians, but to the neoclassicals it is only sensible to prioritize capital over labor, because the wealth will trickle down. Keynes had to gripes with capitalism, its tendency to create systemic unemployment and that distribution of wealth was unjust and unfair, because the reason capital even can pursue their goal of wealth maximization is because of labor. In addition, the Neoclassicals would say that it will return to the equilibrium through Say’s Law, the Keynesians would say: “In the long run we’re all dead.” The neo-Marxists would agree with the Keynesians on that point.

Bibliography

- Cassidy, John. 2009. How Markets Fail. New York: Penguin Group

- Foster, John Bellamy and Robert W. McChesney. 2012. The Endless Crisis. New York, New

York: Monthly Review Press

- Glyn, Andrew. 2006. Capitalism Unleashed: Finance, Globalization, and Welfare. Oxford:

Oxford University Press

- Keech, William R. 2013. Economic Politics in the United States of America. New York:

Cambridge University Press

- Sherman, Howard. J and Michael A. Meeropol. 2015. Principles of Macroeconomics. New

York and Oxford: Routledge

- Skidelsky, Robert. 2009. The Return of the Master. London and New York: Penguin Books